Investor reporting is an essential role for fund managers, and it’s only growing in importance as investors demand higher levels of transparency into their portfolios. This puts pressure on back and middle office teams who need to work against the clock to deliver.

Unfortunately, these personnel hours are spent on repetitive, low-value tasks; manually copying data from different spreadsheets, double-checking latest fund TVPI with the finance team, and frantically making last-minute formatting changes on portfolio company KPIs before the reporting deadline.

This tedious process is often what drives fund managers to invest in software to streamline their reporting operations. However, they often find out that legacy systems fail to accomplish the goal. After spending months (and millions) on building bespoke reporting templates, reporting outputs are customized in a fixed format and lack the flexibility required to evolve alongside business needs. Some managers try popular Business Intelligence (BI) platforms like Tableau, but soon find that these are not built for the private market use cases.

Introducing SmartPage – an intuitive reporting tool for private market managers

So the burning question is – how can private market managers transform their data into insights without paying a small fortune in report customisation costs, and without it taking months to engineer a solution?

“When evaluating a technology solution, it’s important to search for one that can provide you with the outputs you need today and tomorrow,” says Sun Suriyapatanapong, Co-Founder and Partner at Quantium. “At the end of the day, this is one of the most important functions for private markets operations.”

That’s why we introduced Quantium’s latest product, SmartPage. It’s an intuitive Business Intelligence solution built specifically for private markets reporting. We built SmartPage to provide GPs and LPs with the following benefits:

User-friendly, real-time dashboards and reports

First and foremost, it is easy for fund managers to use.

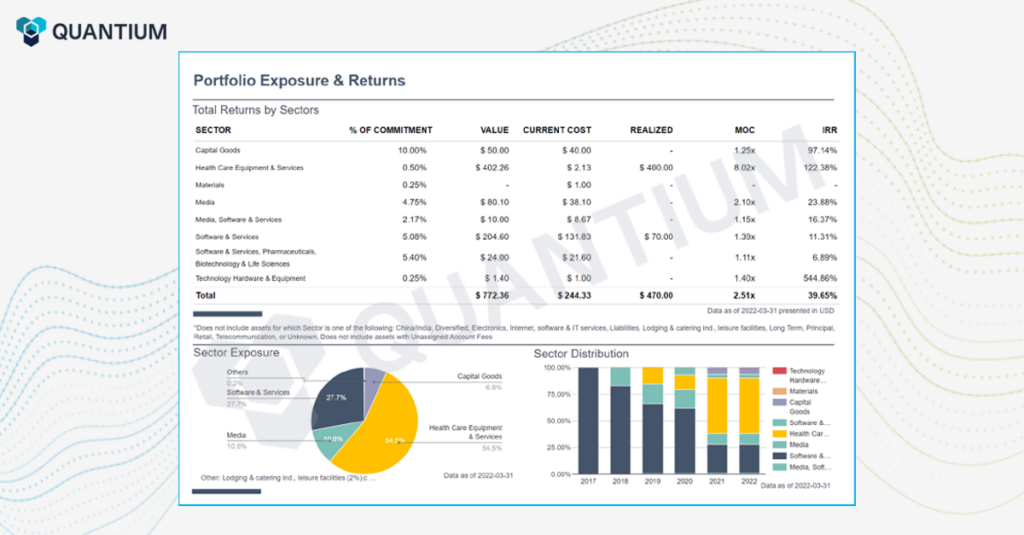

Data is organized by common reporting use cases, such as “Investor summary”, “Fund summary”, “Single Asset” etc. When selecting “Fund Summary”, commonly used metrics such as “Commitment“, “NAV“, “Net IRR“, “DPI” can be selected at a fund level, or filter for a specific investor with a single click.

On SmartPage, once a reporting template with charts and tables are set up, you can run the reports for subsequent periods and for different entities. This greatly saves our clients’s time by minimizing manual work that’s normally required for data gathering and formatting.

Crucially, our software also fully supports integration with Microsoft Office applications. You can export data tables in Excel and charts into PowerPoint, Word and Excel along with the underlying data for easy editing and fine tuning.

Unlimited reporting support from Quantium

A downside of the typical private equity software business model is the notoriously high customization costs. Building a set of reports commonly cost hundreds of thousands of dollars.

We think this needs to change.

Quantium built our reporting tool with a specific goal in mind – we wanted to be able to support close to 100% of client reporting formats. In practice, our tools can handle 90% of client reporting formats with no additional software development work, and thus no extra service fees.

Clients can easily configure their own reports with our reporting tools. For more complicated reporting formats, our Client Solutions team help configure, refine and publish their reporting templates for ongoing use with no additional charges.

A library of best-practice templates and toolkits

Quantium clients often ask us for advice on improving their reporting templates and practices.

Our Client Solutions team works with leading fund managers around the world and our knowledge of private equity operations gives us unique insider knowledge of best-practice processes and templates. So we built a growing library of best-practice templates including:

- Investor reporting pack

- Portfolio summary for fund-of-funds

- Fundraising pack

- Management company dashboard

- Portfolio one-pagers

SmartPage users will have access to our template library of beautifully designed pre-built reports, which they can use as-is or as a base to build on.

Example Use Case #1: A fund of funds receives a request from a large institutional LP to fill in in a 30-column portfolio summary – a task that would normally take their Portfolio team days to prepare.

With SmartPage, users can directly configure a bespoke data fields including specific datasets of each investee fund, and another separate table for direct investments.

Once the reporting template has been set up, the process is now automated. It can be re-used for subsequent quarter reporting. It can also easily be modified to include additional metrics or re-configure internal labelling.

Example Use Case #2: A multi-billion private equity firm wants to fully automate their portfolio one-pagers for their quarterly investor reporting. This report format is complex; it includes company logos, quarterly changes in company financials and a commentary.

The company YTD financial metrics and quarterly comments are typically filled in by Portfolio team on Excel, where a template is sent out to each portfolio company to fill out their current metrics. Only once this is completed and sent back to the Portfolio team, can the analysts begin the real work of compiling static reports that can only be used once. Replicating this process could take anywhere between two weeks to a month.

With Quantium, the process is fully automated. Our Client Solutions team configure a portfolio one-pager template with specific metrics and logos for each portfolio company. KPIs and commentary are updated through Quantium EDGE (our portfolio management module), and the latest quarterly data can be retrieved for each portfolio company.

It’s now ready to be exported to Powerpoint and the Portfolio team can make final tweaks as necessary before sending it to their investors.

Ready to streamline your fund and portfolio reporting?

SmartPage, Quantium’s intuitive Business Intelligence software, is purpose-built for private markets professionals, making fund and portfolio reporting easy and efficient. Are you interested in streamlining your investment operations? Get in touch to request a demo. 📨