Private equity deal values in the region have soared to 55.1% year-on-year according to S&P Global, skyrocketing to total $30.29bn.

Quantium’s Founder & Partner, Jessie Juan, was invited by S&P Global Market Intelligence to comment on the outlook and key drivers in the private markets within Asia-Pacific (ex Japan).

Overview

“Private equity deal activities will vary across different regions,” said Juan. “We’re seeing a temporary slowdown in China and a notable increase in South Asian countries such as Indonesia, Vietnam and India.”

Top Sectors

Technology, clean energy, and the healthcare sector continue to be the APAC favourites for global investors, according to Juan.

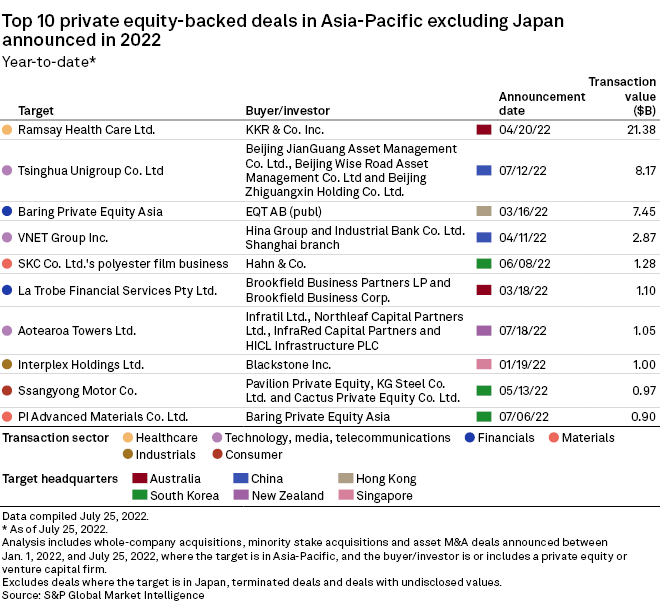

S&P Global Market Intelligence data certainly confirms this, with the chart-topping $21.38 billion acquisition announcement of Australian hospital owner and operator Ramsay Health Care Ltd. (by a consortium led by KKR & Co. Inc) leading the charge as the largest announced PE-backed deal YTD.

Regional Outlook

“Despite some turbulence due to geopolitical tension and a degree of capital outflow, the APAC region continues to be resilient with post-Covid recovery – with the exception of China,” said Juan. “There is solid domestic demand in Asia-Pacific that will continue to drive business growth.”

Read the full analysis and Jessie’s comments here.